Saying that, even without auto enrolment functionality, meeting your obligations usually isn’t that hard.

If you are an employer with auto-enrolment obligations, you should double check for auto-enrolment functionality (for example, calculating pension deductions and supplying information to the pension provider), if you think this will help you fulfil your duties. Most provide payslips (up until recently BPT didn’t!).

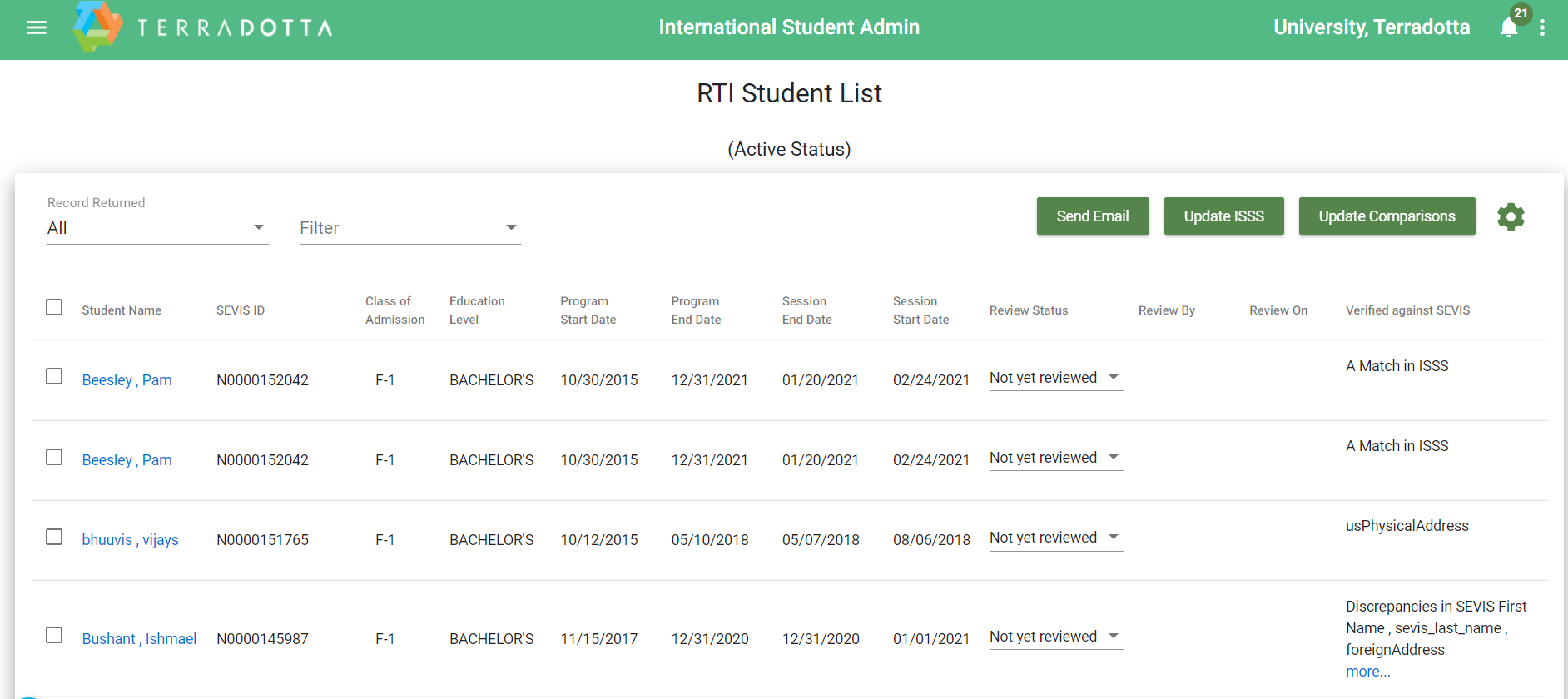

Others run online and so work in a similar way to online banking meaning you will be able to access it from any computer and not just your home one. Some, like BPT have to be installed on your home computer. However, that is where the similarities end. calculating statutory payments, such as maternity or sick pay.working out how much you need to pay HMRC.working out your employees’ pay and deductions.You can find our guide to BPT below.Īll free payroll software should help you with tasks like: In addition, there is HMRC’s Basic PAYE Tools (BPT) – this is a free tool provided by HMRC. You can check HMRC’s list of suppliers of free commercial PAYE software for some options that HMRC have tested and say are suitable for RTI online filing (although see some caveats with regard to HMRC’s PAYE 'recognition', in the section paid software below). You may feel nervous about entrusting an important task like payroll to free software, but many companies launch free basic products as a way to promote their more advanced products.

(Please note that if you do not have a reliable internet connection then you may have grounds to use paper filing under the ‘ unable to online file’ exemption.) Free software It goes without saying that you will need to have a reliable internet connection so that the payroll software can send your reports to HMRC as and when required. First things first though – before making any RTI submissions using your software, you will need to have registered as an employer with HMRC and enrolled to use HMRC's PAYE Online for employers service.

0 kommentar(er)

0 kommentar(er)